Pharma has a ‘return problem’.

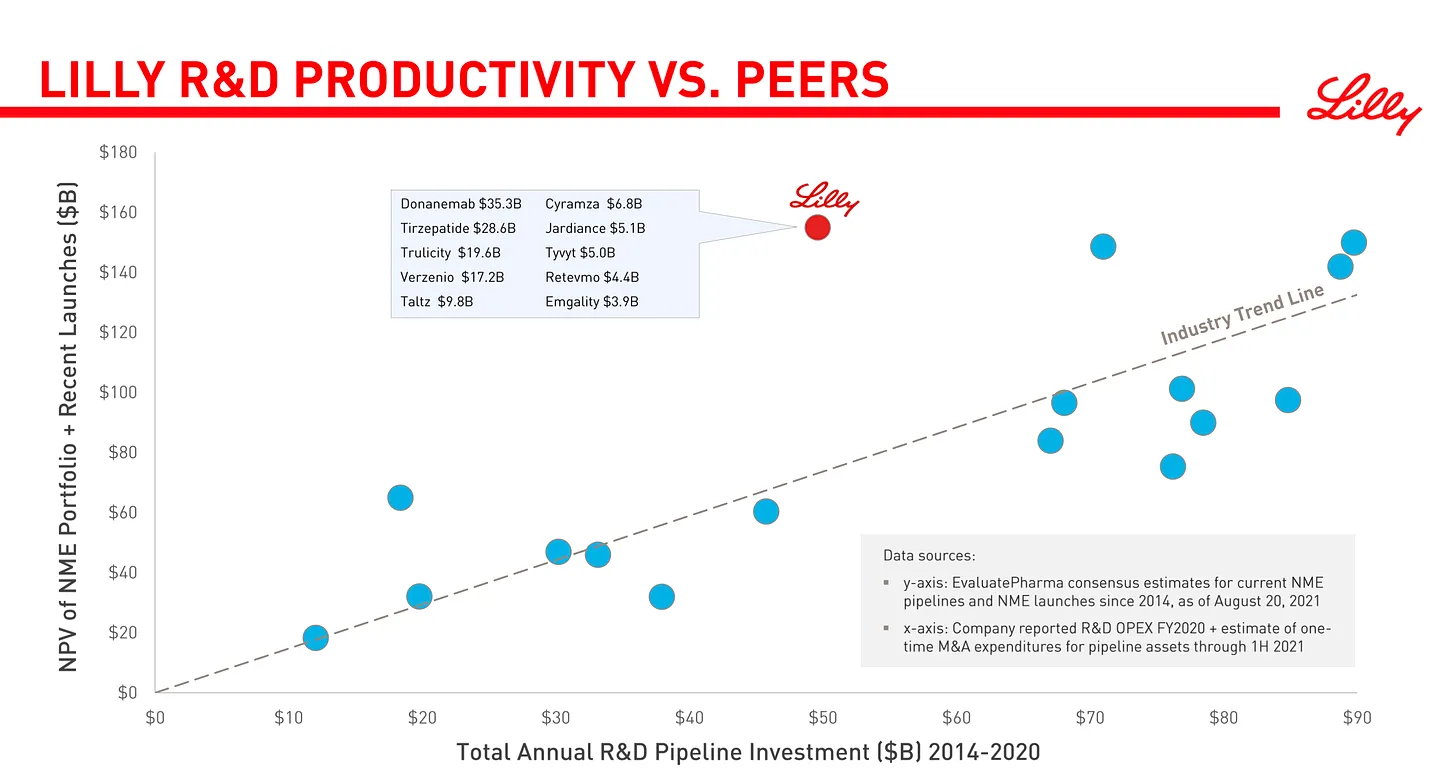

Over on Twitter, this chart from Lilly’s investor deck in 2021 caught the attention of many - partly because they rightly focus on what ‘productivity’ really means - the return on invention.

We weren’t sure who the others on the chart were - whether this was cherry picking, for example - as Lilly look like a significantly more productive organisation than others.

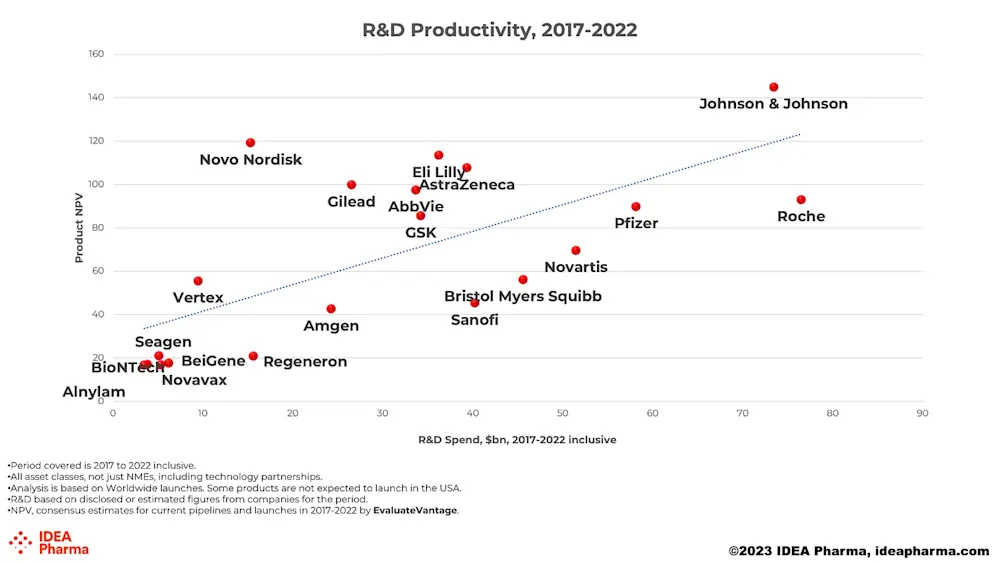

So, we produced our own charts, with great help from EvaluateVantage.

Here is the chart where M&A is not specifically included (that is, it is reported by the companies as R&D spend)

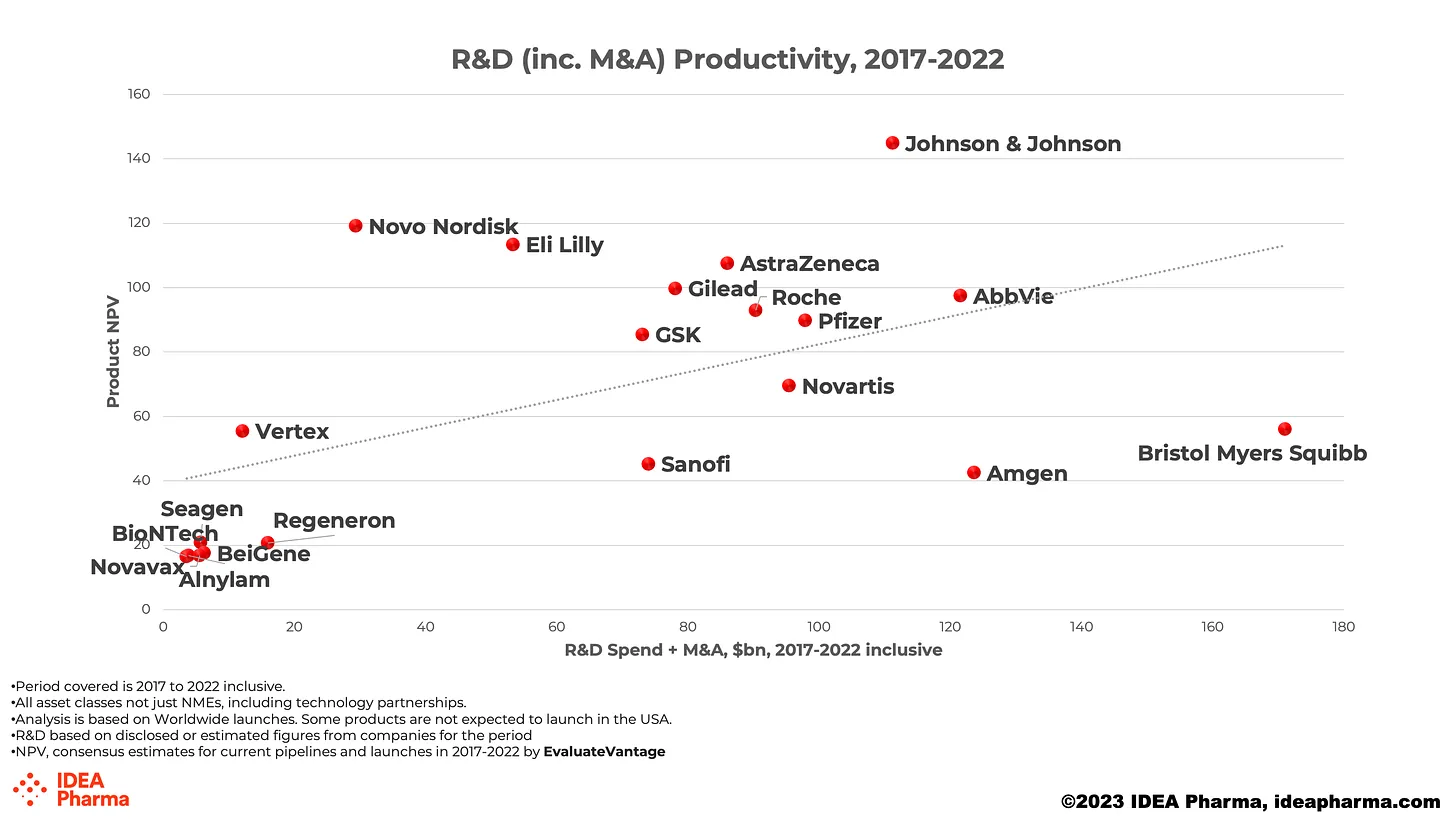

And, here’s the chart where we specifically include M&A (we’ve tried to avoid any double counting)

The extension of that R&D spend axis does provide a little higher resolution on company strategies - late stage acquisitions vs in-house R&D.

As with so many views of our larger companies, the snapshots are revealing. Of course, Lilly still look good, but hardly the standout outlier in terms of productivity that their chart suggested.

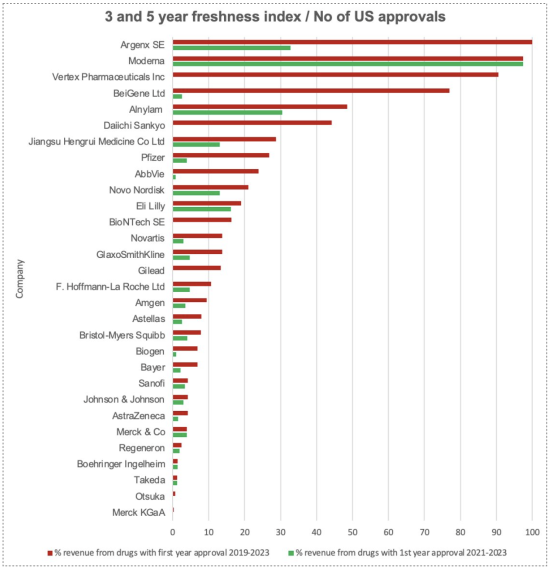

As I said, in discussion of the 2023 Freshness Index, we can have different viewpoints on the ‘right’ number, but we have to conclude

There are no ‘average’ companies

Companies differ in their ability to launch drugs, and to launch successful drugs

Companies who were ‘above the line’ without M&A spend are still there if you include it

As I said here,

"There’s no perfect measure of ‘success’ in pharma, but the analyses all show the same thing in different ways… Pharma has a ‘return problem’."

But maybe I should have been more specific. It isn’t every company that struggles with this - the challenge is not at a structural, or organisational level - but at a cultural level: decision making, agility, focus, incentives and more.

IDEA Pharma

We work with clients early in lifecycle, crafting a compelling product story and building a best-in-class strategy that helps every molecule reach its potential. It’s what we do best. And there’s nobody that does it quite like us IDEA Pharma